* This is my column in BusinessWorld on August 22, 2019.

“The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary”

— H. L. Mencken, December 1921

The main purpose of climate alarmism is to expedite government environmental and energy taxation to further expand government and the United Nations (UN). Scare the public endlessly, like declaring a “climate crisis/emergency” whatever the weather and climate: less rain and more rain, less flood and more flood, less storms and more storms, less cold and more cold.

There is a legislative proposal to impose a “climate tax on electricity” (CTE) for residential customers under HB 1245 of Congressman Luis Raymund Villafuerte, Jr. The proposed CTE will be P1 per kilogram of carbon dioxide (CO2) emission. It claims that since CO2 emission comprises 0.553 kg per kWh of electricity, then CTE = 0.553 x electricity consumption in a month.

In our house for instance, our average electricity use from May to July was around 280 kWh/month. If the Villafuerte bill becomes a law, then we must pay P155/month extra for this CTE, on top of feed in tariff allowance (FIT-All) of around P65-P70/month that goes to the favored and privileged mostly solar-wind companies.

This year, we experienced frequent “yellow alert” warnings (thin reserves) from the National Grid Corporation of the Philippines (NGCP) for five months, March to July. There were few days where “red alert” was raised, meaning short rotating black-outs were made to forcibly reduce power demand.

The good news is that new big power plants will begin operation in the Luzon grid starting August-September 2019 until 2021.

I made a short-term projection of power supply-demand, limited to the Luzon grid due to space constraints. Peak demand from 2015-2018 was rising by 5.7% a year on average, so for 2019-2023, I projected a 5.5% annual increase due to GDP growth deceleration recently. From there, I computed the projected reserves (see table).

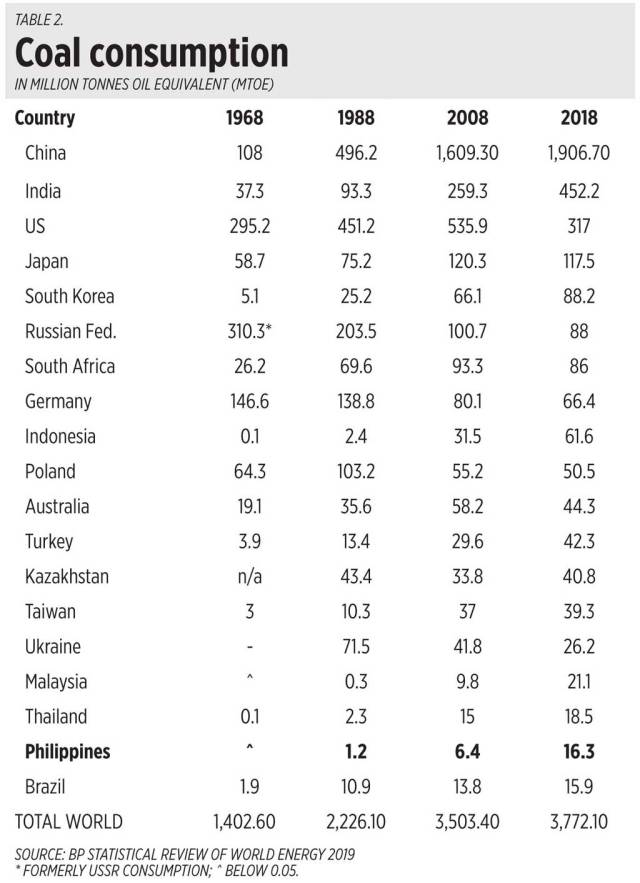

Now, since most of those new big power plants run on fossil fuels especially coal, then Rep. Villafuerte and allies will likely push their lousy and idiotic proposal to further raise the cost of already costly electricity in the country. The Philippines has the third most expensive electricity in Asia next to Japan and Singapore.

Note also that the high reserves percentage can be deceiving because many existing power plants are old, especially coal and hydro plants, they tend to experience unscheduled and forced outages, and extended maintenance shutdown. Thus, actual reserves can be lower than these projections.

The House Committee on Ways and Means and Congress as a whole should junk this and related bills that intend to make electricity more expensive.

Things can worsen though if the triumvirate of the Department of Finance, Department of Budget and Management, and National Economic and Development Authority support this bill in the name of helping “save the planet.” Recall the hike in the excise tax on oil under the TRAIN law by P6/liter over 2018-2020 was pushed by the triumvirate to finance various welfare programs and partly to “save the planet” by discouraging more oil use. Oil consumption of course did not decrease because it is a necessary and useful commodity that is used in many sectors and machines from tractors and fishing boats to cars, busses and airplanes.

The triumvirate should learn their lesson that more expensive energy means higher inflation, which helped pull down overall GDP growth. They plus the Department of Energy should call for the junking of this and related bills in Congress.

Cheaper electricity, lower inflation, sustained high growth, more investments and job creation, no additional and distortionary energy taxes, these should be the primary goals of the administration in its last three years.

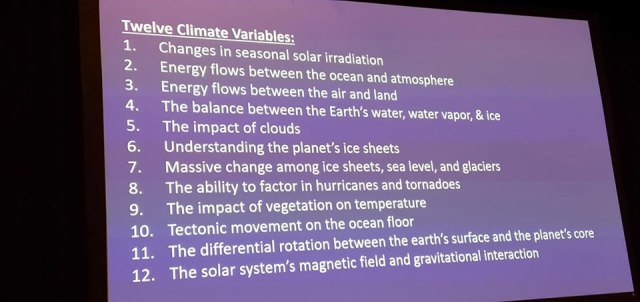

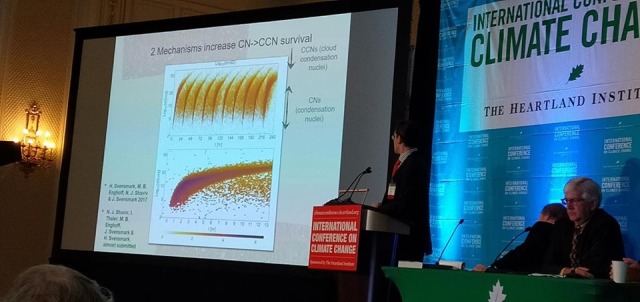

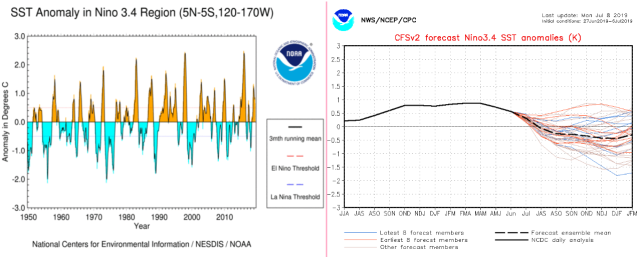

WASHINGTON, DC — The various presentations at the Heartland Institute’s 13th International Conference on Climate Change (ICCC-13) on July 25 in this city reiterated what many scientific papers from the fields of meteorology, geology, climatology, physics, chemistry, biology, mathematics, etc. have found — there is no climate crisis or climate emergency.

WASHINGTON, DC — The various presentations at the Heartland Institute’s 13th International Conference on Climate Change (ICCC-13) on July 25 in this city reiterated what many scientific papers from the fields of meteorology, geology, climatology, physics, chemistry, biology, mathematics, etc. have found — there is no climate crisis or climate emergency.